We’ve heard this over and over again from our clients.

Applying for a credit card? Denied.

Applying for a cell phone? Denied.

Taking a loan to purchase a new car? Denied.

And the most common one? Inappropriately high interest rates, that keep bothering you every single month.

Realizing that you have bad credit score is never a pleasant experience and the timing is usually as bad as it can be.

Is your credit score really good enough to rely on when the emergency arises?

Think about it.

According to Federal Trade Commission’s report, 1 in 4 Americans have errors in their report.

That’s not too low of a chance that you’re one the unfortunate ones, is it? These errors lower the score, with many cases being so serious that person gets overcharged for everything, starting from credit card debt and car loans to insurance policies.

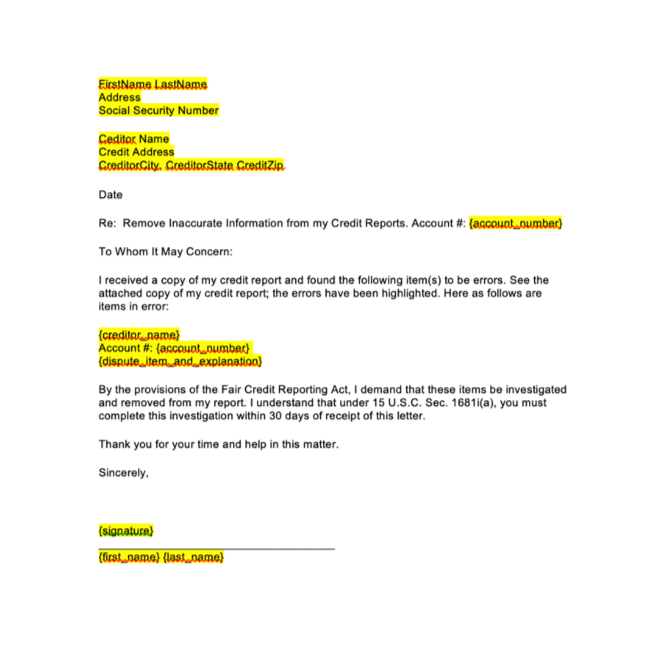

Luckily, this is not the end of the story. With a bit of patience and smart use of our credit repair letters, you can drastically improve your credit score in no time.